Oil and Gasoline Correlation Charts

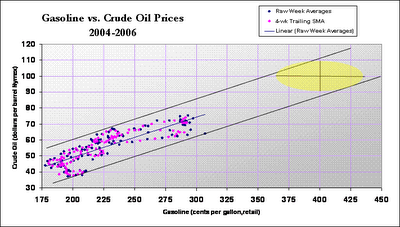

In an effort to project what American gasoline prices might look like in the near future, I have run the following correlations between the price of crude oil and the average price of regular gasoline paid at the pump.

The data points represent the average price of crude oil in a given week and the average price of gasoline in the following week. The center-line is a computer plotted trendline. I added the longer parallel outside lines to mark a probable path.

This first chart uses data going back to Jan 2002, when prices were obviously much lower.

This second chart only uses data going back to January 2004, so we get slightly different results. I have also added in a second data-set(in pink) which are simply 4-week trailing moving averages of the original raw, weekly averages.

As you can see, for any given price of either crude-oil or gasoline, there is a wide range of corresponding possible prices for the other commodity.

From this analysis, it is within reason to suggest we could be seeing $4 gasoline as early as when we hit $90 oil. Or it could take as much as $120-oil.

1 Comments:

Oil CEO,

Bill here. I like your analysis.

IMHO $90 = $4/Gal. So what does that imply... for every $30 rise = $1 gas rise? I have also been reviewing TOD and all they seem to focus on is supply. I think we need to think about demand. I think we have to move beyond the peak oil debate. Its over. We have to move to the economic and political implications of steadily increasing prices. Where is the "break" point? That was my thought when I reviewed your oil vs GDP chart. The maximum oil got to is 8% of GDP. I think that implies $120 oil today (?). So when do we get there?

At what point does the price of oil affect our "way of life"

How essential is oil really?

We are going to find out, but I think we need to think through the possible scenarios.

"demand destruction" is a buzz word, but what does it really mean?

At what point do supply and demand reach stability - given steadily decreasing supply?

Then we need to look at countries that have been (and are) 100% oil importers. Like Japan and Europe. How are they reacting?

Business Week had a good article last week on % of driving done for work, leisure, etc in the US. Only about 25% is work. Most driving in the US is "non-essential" ... so do we all just switch to scooters like Italy?

The US imports about 11M barrels a day, or about 70% of consumption. At $70 thats a 281B deficit a year. People seem OK with it now. If it doubles, is that OK? How long do we have till that happens?

Personally I think the political implications are dire. We are heading towards a brick wall, but we don't know when we will hit it. The US will be forced to dramatically revise its global defence strategy, which will have a geopolitical fallout I cannot even imagine. When I think it through, the only rational response is to buy gold. I feel like Henny Penny. I have seen some discussions that say this is an overreaction. People have been looking for an excuse to forcast "doomsday" for hundreds of years. Is this just that? another fantasy doomsday scenario that modern ingenuity and economics will overcome?

CEO, what do you think?

Post a Comment

<< Home